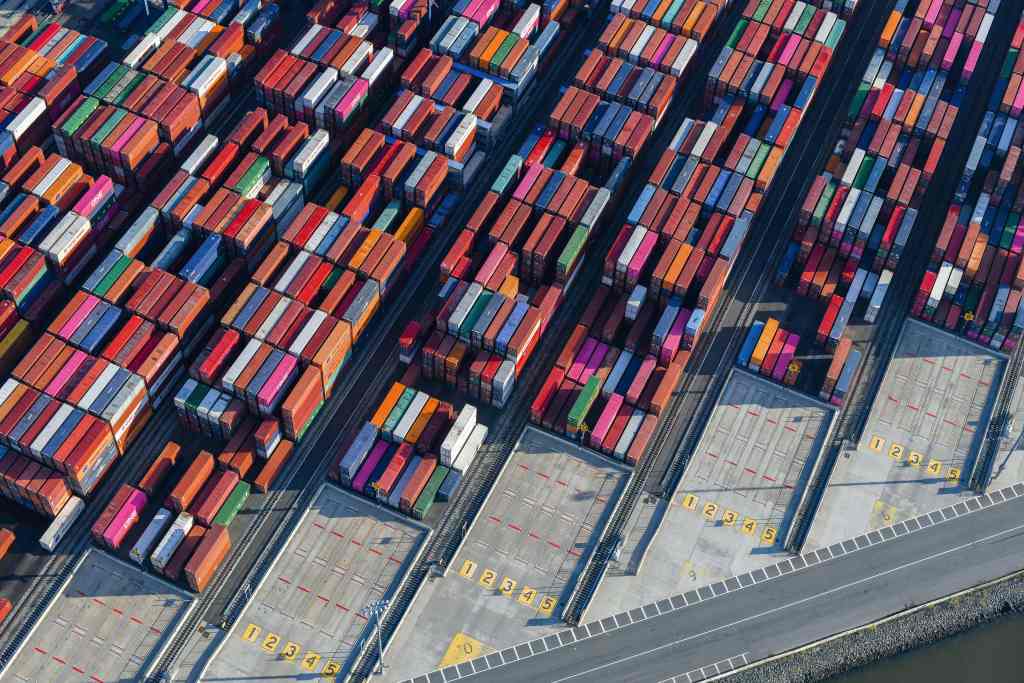

Port of Los Angeles, Long Beach hit near-record imports Influx ensues surge in container dwell times

Ports of Los Angeles and Long Beach, two of the main ports serviced by Trans International,

produced import volumes that nearly rival the records set during the height of the COVID-19

pandemic.

In July, the Port of Los Angeles (POLA) processed a remarkable 939,600 Twenty-Foot

Equivalent Units (TEUs), while the Port of Long Beach (POLB) handled 882,376 TEUs.

These account for approximately one-third of all U.S. container imports.

The surge in import volumes has been primarily driven by retailers and other importers stocking

up ahead of potential U.S. tariffs on Chinese goods and a possible ILA strike on the East Coast.

According to recent data released by the National Retail Federation and Hackett Associates,

U.S. container imports through major ports are projected to reach 24.9 million TEUs this year,

representing a 12% increase from last year.

Longer Dwell Times

As the two ports experienced increased import volumes, container dwell times doubled.

On 26 August, POLA reported that almost 28% of the rail containers at the port’s six container

terminals saw an average dwell time of six days or longer.

“That’s far too high. It needs to be between two and four days. We also have about 7,900 rail

containers designated for on-dock loading that are nine days and longer dwelling here at the

Port of Los Angeles Terminals. That number, 7,900 needs to be down about a thousand

thereabouts,” POLA Executive Director Gene Seroka said.

Meanwhile, Long Beach Container Terminal recorded an average dwell time of six to seven

days, almost twice the dwell time recorded in June.

Port customers expressed concern about longer dwell times, as it could potentially worsen when

the two ports enter their busiest time of the year.

Customers said import volumes in Southern California increasing due to normal season growth,

diversions of discretionary cargo from the East and Gulf coasts, rail congestion issues in

Tacoma, and work stoppage issues in Vancouver, Canada could further increase the dwell times

in the ports.

“Despite these record volumes, operations at our container terminals remain fluid. We are not

seeing any unusual backlogs or container pileups as we did during the pandemic-induced

supply chain crisis,” Port of Long Beach chief operating officer Noel Hacegaba said.

“On-dock rail is key to keeping the fluidity for all these terminals,” Seroka said, pertaining to the

terminals in POLA. “It represents almost a third of the cargo and keeping that product moving

out quickly allows us more maneuverability on the terminals for imports and exports alike.”